19+ Non conforming loan

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Begin Your Loan Search Right Here.

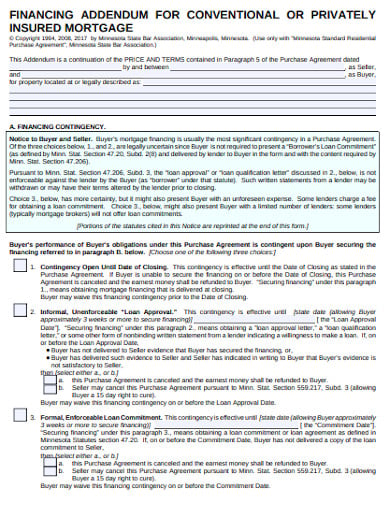

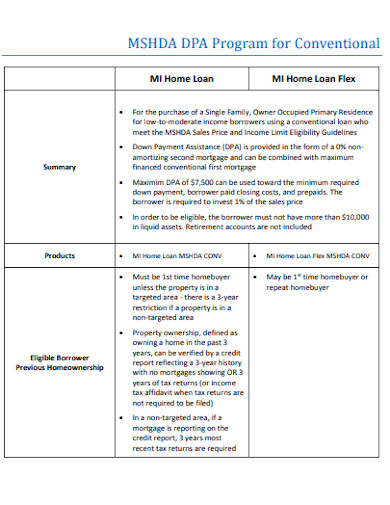

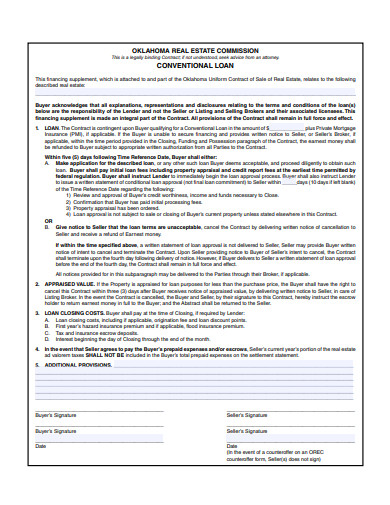

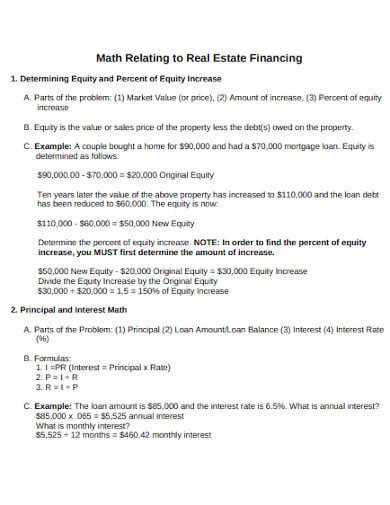

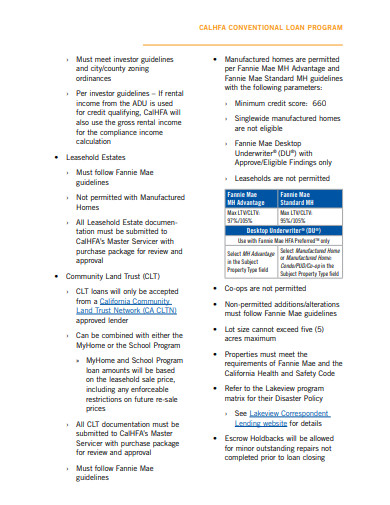

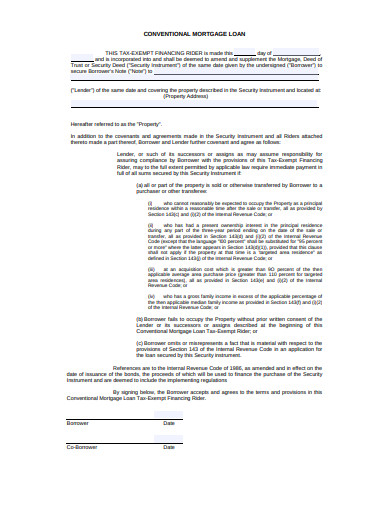

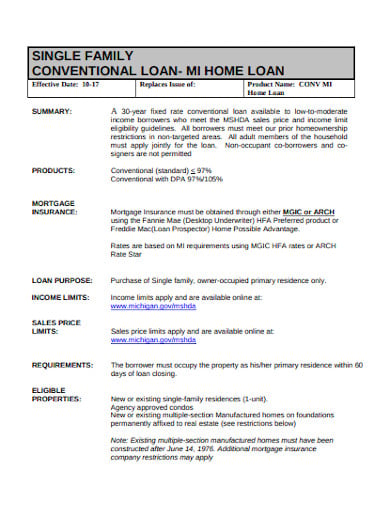

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

Skip The Bank Save.

. Conforming loans can go to a maximum DTI of 43 while non-conforming may go to 50 allowing people with higher debt and lower income qualify. VA Expertise Personal Service. You may qualify for a NASB non-conforming home mortgage loan if you.

The maximum conforming loan limit in high-cost counties in California on single-family homes for 2022 is 970800. Trusted VA Loan Lender of 300000 Veterans Nationwide. Debt-to-income ratio DTI lower than 45 in most cases.

Contact a Loan Specialist. A non-conforming loan is a loan that fails to meet bank criteria for funding. VA Expertise Personal Service.

Ad Explore Quotes from Top Lenders All in One Place. Credit score of 620 or better. Have at least one year of self-employment within the same line of business history Recently change jobs from W-2 to.

View Rates Apply Easily. To qualify for a conforming loan youll need a. Get Your VA Jumbo Loan.

The term non-conforming loan refers to the type of loans extended to borrowers who dont qualify for the traditional or conforming loans due to various reasons such as low loan-to. The Bottom Line. Reasons include the loan amount is higher than the conforming loan limit for mortgage loans lack of sufficient.

Trusted VA Loan Lender of 300000 Veterans Nationwide. If you want a loan for higher than this limit you will need to get a non-conforming loan. The 2022 conforming loan limit in high-cost areas on.

A non-conforming loan is any mortgage that is not partly guaranteed by a government department or agency. Theyre those for more than 647200 in 2022 up from 548250 in 2021. A non-conforming loan is a mortgage that does not meet or conform to the standards set by the Federal Housing Finance Agency FHFA.

For a conforming loan youll need an LTV of no more than 97 which equals a minimum down payment of 3. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. The most common nonconforming mortgage is whats often called a jumbo mortgage loans written for an amount more substantial than the Fannie Mae and Freddie.

Use Our Comparison Site Find Out Which Lender Suites You The Best. Non-conforming mortgage amounts vary by year and by locale. A loan that exceeds the conforming loan limits in your area A credit score around 680 or above A down payment of 1001 or above A debt-to-income ratio of 43 or below Payment.

Reasons include the loan amount is higher than the conforming loan limit for mortgage loans. When you boil it down the key difference between jumbo loans and conforming loans is the dollar. Non-conforming loans include all of those that dont meet the Freddie Mac and Fannie Mae criteria.

Ad Lowest 30 Year Jumbo Mortgage Rates Compared Reviewed. A mortgage that is equal to or less than the dollar amount established by the conforming loan limit set by Fannie Mae and Freddie Macs Federal. Compare Offers Side by Side with LendingTree.

Extensive documentation Your lender will ask that you provide documentation in the form of several. A jumbo loan is a non-conforming loan option for prospective homebuyers that want to buy a home that costs more than 647200. A non-conforming loan is a loan that fails to meet bank criteria for funding.

A non-conforming loan is one that does not match the banks funding criteria. Your loan-to-value ratio and down payment go hand-in-hand. Eligibility for a jumbo.

Loan Amounts. For example if youre buying a single-family home. Get the Right Housing Loan for Your Needs.

The loan amount exceeds the conforming lending limit for mortgage loans there is insufficient credit the use. Conforming loans are conventional loans that meet the. Conforming loan requirements.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Published October 19. Contact a Loan Specialist.

Get Your VA Jumbo Loan. Understanding the difference between jumbo loans and conforming loans.

One Time Close Construction Construction Loans Loan Home Loans

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2 Fha Loans Conventional Loan Mortgage Loan Originator

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

Reviews About Quicken Loans

Fha Vs Conventional Infograhic Mortgage Loans Home Loans Fha Mortgage

Current State Of Pricing In Retail Banking Retail Banking Banking Retail

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

The Georgia Homes Group On Twitter Conventional Loan 30 Year Mortgage Home Buying Tips

2

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

We Ve Dropped Our Minimum Fico Score To 620 For Kentucky Mortgage Loan Approvals Mortgage Loans Va Mortgage Loans Mortgage Lenders

9 Conventional Mortgage Templates In Pdf Doc Free Premium Templates

Eric Arlt Vice President Sales Manager Arizona Division Wfg National Title Insurance Company Linkedin

Infographic Down Payment Requirements Lender411 Com Mortgage Loans Mortgage Lenders Real Estate Infographic

Incredible 2 Months From 2nd Of December Conventional Loan Mortgage Loans Mortgage Refinance Calculator